How To Become Rich?

Do you ever find yourself daydreaming about a life of luxury and financial abundance? If so, you’re not alone. Many people aspire to become rich, but they often wonder how to make it a reality. Well, you’re in luck because I’m here to share some valuable insights on how to become rich. Now, I won’t promise you overnight success or a magic formula, but I can provide you with practical tips and strategies that can set you on the path to financial prosperity.

Becoming rich is not just about luck or chance; it requires a combination of hard work, smart decisions, and a mindset geared towards success. In this article, we’ll explore various avenues that can help you achieve wealth and financial freedom. From building multiple streams of income to investing wisely and managing your money effectively, we’ll cover it all. So, if you’re ready to embark on this exciting journey towards wealth creation, let’s dive in and discover the secrets to becoming rich!

How to Become Rich?

- Set Clear Financial Goals: Start by setting specific and achievable goals for your finances.

- Create a Budget: Develop a budget to track your income and expenses and ensure you’re saving money.

- Invest Wisely: Learn about different investment options and make informed decisions to grow your wealth.

- Build Multiple Streams of Income: Explore side hustles or passive income sources to increase your earnings.

- Continuously Educate Yourself: Stay updated on financial trends and strategies to make smarter financial choices.

- Manage Debt: Prioritize debt repayment and avoid unnecessary debt to improve your financial situation.

- Stay Persistent and Patient: Building wealth takes time and effort, so stay committed to your financial goals.

How to Become Rich: A Guide to Financial Success

Are you tired of living paycheck to paycheck? Do you dream of a life filled with financial abundance and freedom? If so, you’re not alone. Many people aspire to become rich, but few know where to start or how to achieve their goals. In this article, we’ll explore various strategies and principles that can help you on your journey to wealth. From mindset shifts to practical steps, we’ll cover it all. So, let’s dive in and discover how you can become rich!

1. Set Clear Financial Goals

Before embarking on any journey, it’s important to have a destination in mind. The same goes for your financial journey. Take some time to define your financial goals. Do you want to build a business, invest in real estate, or create multiple streams of passive income? Setting clear and specific goals will give you direction and purpose.

Once you’ve identified your goals, break them down into smaller, actionable steps. For example, if your goal is to start a business, your action steps might include researching your market, creating a business plan, and securing funding. By breaking your goals down into manageable tasks, you’ll be more likely to follow through and achieve success.

2. Develop a Wealthy Mindset

One of the key factors in becoming rich is having the right mindset. Your thoughts and beliefs about money can either propel you forward or hold you back. Cultivate a mindset of abundance and wealth. Believe that you deserve to be successful and that money is a positive force in your life.

Challenge any negative beliefs or limiting thoughts you may have about money. Replace them with positive affirmations and empowering beliefs. Surround yourself with like-minded individuals who support your financial goals. By changing your mindset, you’ll open yourself up to new opportunities and attract wealth into your life.

3. Educate Yourself about Money

Financial literacy is crucial on your path to becoming rich. Take the time to educate yourself about money, investing, and personal finance. Read books, attend seminars, and follow reputable financial experts. The more you know, the better equipped you’ll be to make informed decisions and grow your wealth.

Additionally, consider working with a financial advisor or mentor who can provide guidance and support. They can help you create a personalized financial plan and offer insights based on their experience. Remember, knowledge is power when it comes to building wealth.

3.1 Benefits of Financial Education

Investing in your financial education has numerous benefits. Firstly, it empowers you to make sound financial decisions and avoid costly mistakes. Secondly, it opens up new opportunities and allows you to take advantage of lucrative investments. Lastly, it gives you the confidence and knowledge to navigate the complex world of finance.

By continuously learning and expanding your financial knowledge, you’ll gain a competitive edge and increase your chances of achieving financial success.

4. Create Multiple Streams of Income

Relying solely on a single source of income can be risky. To truly become rich, consider diversifying your income streams. This can include starting a side business, investing in stocks or real estate, or creating passive income streams through royalties or rental properties.

Having multiple streams of income not only provides financial security but also accelerates your wealth-building journey. It allows you to leverage different opportunities and maximize your earning potential. By diversifying your income, you’ll be better prepared to weather financial storms and thrive in any economic climate.

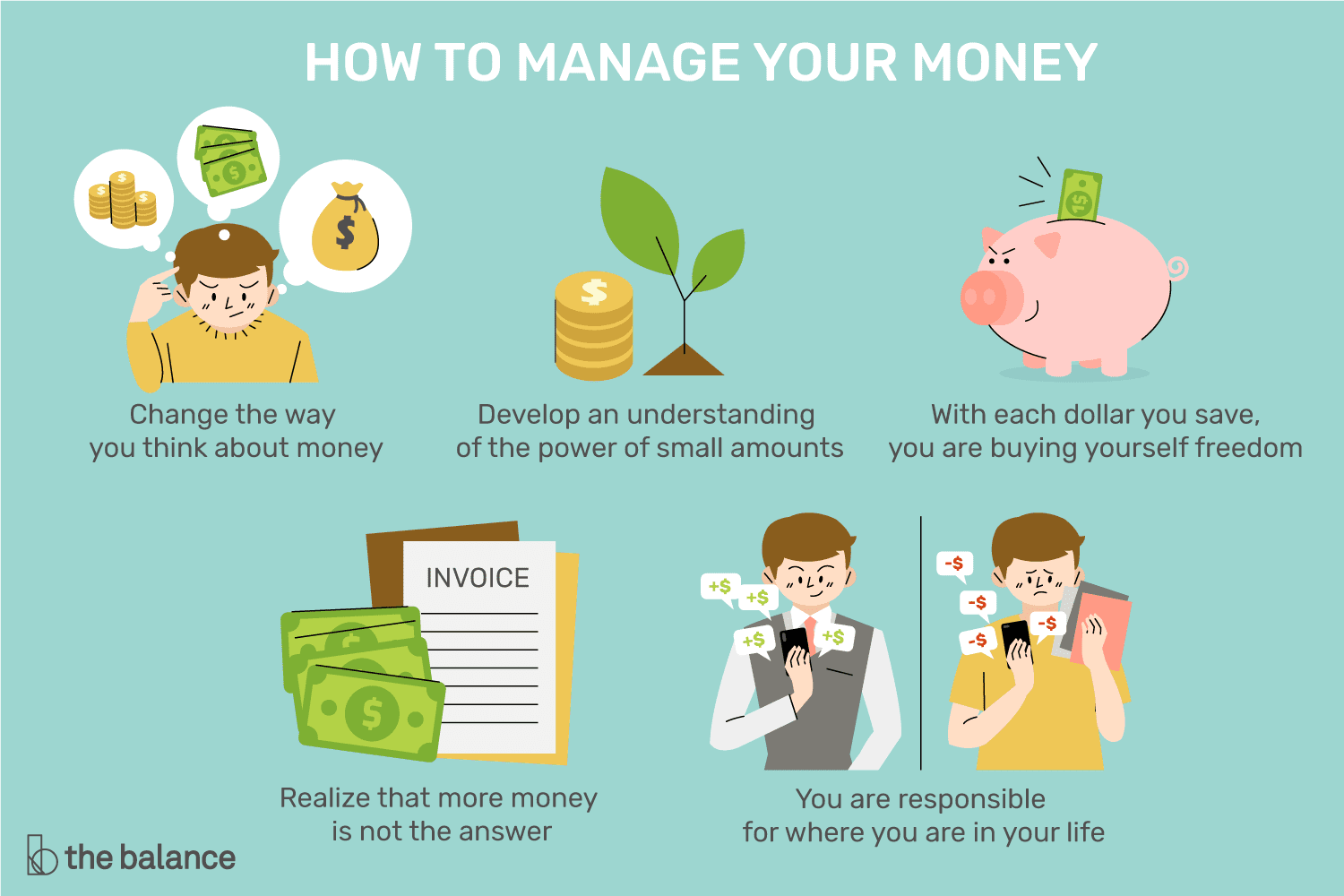

5. Practice Smart Money Management

Becoming rich isn’t just about earning more money; it’s also about managing it wisely. Develop good financial habits such as budgeting, saving, and investing. Create a budget that aligns with your financial goals and stick to it. Set aside a portion of your income for savings and investments.

Investing wisely is also crucial. Research different investment options and choose ones that align with your risk tolerance and financial goals. Consider working with a financial advisor to make informed investment decisions. Over time, your investments can generate passive income and contribute to your overall wealth.

5.1 The Power of Compound Interest

One of the most powerful wealth-building tools is compound interest. By starting early and consistently investing, you can harness the power of compounding to accelerate your wealth. Compound interest allows your investments to grow exponentially over time, resulting in substantial returns.

Take advantage of retirement accounts, such as 401(k)s or IRAs, that offer tax advantages and compound interest. By investing consistently and allowing your money to grow over the long term, you can significantly increase your wealth.

6. Surround Yourself with Successful People

They say that you become the average of the five people you spend the most time with. If you want to become rich, surround yourself with successful and like-minded individuals. Seek out mentors who have achieved financial success and learn from their experiences.

Networking is also crucial. Attend industry conferences, join professional organizations, and connect with individuals who share your goals and aspirations. By surrounding yourself with successful people, you’ll be inspired, motivated, and exposed to new opportunities.

7. Take Calculated Risks

Building wealth often involves taking risks. However, it’s important to take calculated risks rather than blind gambles. Educate yourself about the potential risks and rewards of any investment or business opportunity.

Consider starting small and gradually scaling up as you gain experience and confidence. Diversify your investments to spread the risk. And always have a backup plan in case things don’t go as expected. By taking calculated risks, you’ll position yourself for potential financial gains while minimizing potential losses.

7.1 Risk vs. Reward: Finding the Balance

When it comes to risk, finding the right balance is crucial. Taking too little risk may limit your potential returns, while taking too much risk can lead to significant losses. Evaluate each opportunity carefully and weigh the potential rewards against the associated risks. Strive for a balanced approach that aligns with your risk tolerance and financial goals.

8. Stay Persistent and Resilient

Building wealth is a journey that requires persistence and resilience. There will inevitably be setbacks and obstacles along the way. However, it’s important to stay focused on your goals and maintain a positive mindset.

Learn from your failures and use them as stepping stones to success. Surround yourself with a support network that encourages and uplifts you during challenging times. Remember, every successful person has faced adversity; it’s how you respond that determines your ultimate success.

9. Give Back and Practice Gratitude

True wealth encompasses more than just financial abundance. It also includes a sense of fulfillment and giving back to others. As you strive to become rich, don’t forget to practice gratitude and generosity.

Give back to your community and support causes that align with your values. Whether it’s through charitable donations or volunteering your time, contributing to the well-being of others can bring a deep sense of fulfillment. Remember, true wealth is about making a positive impact on the world around you.

Conclusion

Becoming rich is possible for anyone who is willing to put in the effort and adopt the right mindset. By setting clear goals, developing a wealthy mindset, continuously learning, diversifying your income, practicing smart money management, surrounding yourself with successful people, taking calculated risks, staying persistent, and giving back, you can pave your own path to financial success. So, start today and take the first step towards becoming rich!

Key Takeaways: How to become rich?

- Set clear financial goals and create a plan to achieve them.

- Save and invest your money wisely to grow your wealth over time.

- Develop multiple sources of income to increase your earning potential.

- Continuously educate yourself about personal finance and investment strategies.

- Practice disciplined spending habits and avoid unnecessary debt.

Frequently Asked Questions

Question 1: What are some effective strategies for becoming wealthy?

Building wealth requires a combination of smart financial decisions and consistent effort. Here are some strategies that can help you on your journey to becoming rich:

1. Create a budget and stick to it: Track your income and expenses to ensure you’re saving and investing enough.

2. Invest wisely: Diversify your investments across different asset classes and consider seeking professional advice.

3. Increase your income: Look for opportunities to earn more money, whether through career advancement, side hustles, or passive income streams.

4. Minimize debt: Pay off high-interest debts as quickly as possible to free up more money for saving and investing.

5. Continuously educate yourself: Stay updated on financial trends and strategies to make informed decisions.

Question 2: How important is saving money for becoming rich?

Saving money is a crucial step on the path to wealth. Here’s why:

1. Building an emergency fund: Having a financial safety net can protect you from unexpected expenses and prevent you from going into debt.

2. Investing opportunities: Saving allows you to accumulate funds that can be used for investments, such as stocks, real estate, or starting a business.

3. Compound interest: By consistently saving and investing, you can take advantage of compound interest, which allows your money to grow exponentially over time.

4. Financial freedom: Saving money gives you the freedom to pursue your passions, retire early, or handle any financial setbacks that may arise.

Remember, even small savings can add up over time, so start saving as early as possible.

Question 3: How can I develop a millionaire mindset?

Developing a millionaire mindset involves adopting a certain set of beliefs and habits. Here are some steps to help you:

1. Set clear financial goals: Define your objectives and create a plan to achieve them.

2. Practice positive thinking: Cultivate a positive mindset and believe in your ability to create wealth.

3. Learn from successful people: Study the habits and strategies of successful individuals and apply them to your own life.

4. Embrace failure: View setbacks as learning opportunities and persist in the face of challenges.

5. Surround yourself with like-minded people: Surrounding yourself with individuals who have similar goals can provide motivation and support.

Remember, developing a millionaire mindset takes time and effort, but it can greatly increase your chances of financial success.

Question 4: Is starting a business a viable path to becoming rich?

Starting a business can be a viable path to becoming rich, but it requires careful planning and hard work. Here are some considerations:

1. Identify a profitable niche: Research market trends and identify a product or service that meets a demand.

2. Develop a solid business plan: Outline your goals, target market, marketing strategies, and financial projections.

3. Secure adequate funding: Determine the financial resources needed to launch and sustain your business.

4. Build a strong network: Establish connections with potential customers, partners, and mentors who can support your business growth.

5. Adapt and innovate: Stay agile and open to evolving market conditions, and continuously seek ways to improve your products or services.

Starting a business can be risky, but with the right approach and dedication, it can lead to significant financial success.

Question 5: How can I leverage the power of investments for wealth creation?

Investments can be a powerful tool for wealth creation. Here’s how you can leverage their potential:

1. Diversify your portfolio: Spread your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to minimize risk.

2. Start early and be consistent: The power of compounding works best when you start investing early and contribute regularly over time.

3. Seek professional advice: Consider consulting with a financial advisor who can help you make informed investment decisions.

4. Stay informed: Continuously educate yourself about investment strategies and market trends to make well-informed choices.

5. Monitor and adjust: Regularly review your investments and make adjustments as necessary to align with your financial goals.

Remember, investing involves risk, so it’s important to have a long-term perspective and be prepared for potential fluctuations in the market.

The BEST Way To Get RICH In 2023.

Final Thoughts

So, you’re here because you want to know the secret to becoming rich, right? Well, I wish I could give you a magic formula or a guaranteed plan that would make you a millionaire overnight. But the truth is, there is no one-size-fits-all answer to this question. However, there are some principles and strategies that can increase your chances of achieving financial success.

First and foremost, it’s important to develop a positive mindset. Believe in yourself and your ability to achieve your goals. Take risks, learn from your failures, and never give up. Surround yourself with like-minded individuals who will support and inspire you along the way.

Secondly, financial education is key. Take the time to learn about money management, investments, and how to make your money work for you. Invest in yourself by acquiring new skills and knowledge that can enhance your earning potential.

Lastly, be disciplined and patient. Rome wasn’t built in a day, and neither is wealth. It takes time, effort, and perseverance to build a solid financial foundation. Stay focused on your goals, avoid unnecessary debt, and make wise financial decisions.

Remember, becoming rich is not just about accumulating wealth, but also about finding fulfillment and happiness in the process. So, start taking small steps today towards a brighter and financially secure future. You’ve got this!